By Philip La Greca

Executive Manager, SMSF Technical & Strategic Services

With the expansion of the maximum number of members permitted in an SMSF from four to six members, we are receiving questions about the best way to accommodate adding these extra members. Now could be the time to consider changing to a corporate trustee.

From a legislative viewpoint there is no preference however, there are practical issues to consider in deciding on a preferred structure.

Under the SIS legislation, an SMSF must either have a company act as trustee of the fund or a group of individuals. A single member fund must therefore appoint a second individual trustee to comply with SIS legislation and control and responsibility will be shared equally across both. A corporate trustee can have a sole director, therefore allowing a single member full control over the management of the fund.

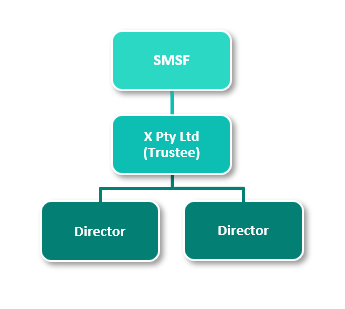

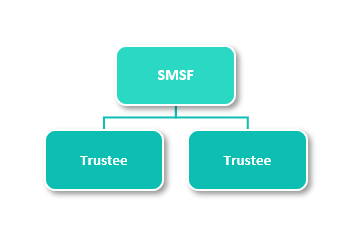

In addition, each member of the SMSF must be a trustee of the fund, or where the trustee of the SMSF is a company, each member must be a director of the company. A SMSF with two members could therefore have the following trustee structures:

As the membership increases so too does either the number of individual trustees or the number of directors of the trustee company.

The following are several considerations and potential advantages of each structure below.

Administrative considerations

All assets of the SMSF must be held in the name of the trustees. Under the corporate trustee structure, all assets of the fund are held in the name of the corporate trustee company as trustee for the SMSF. In the case of individual trustees, all fund assets are held in the name of the individuals as trustee for the SMSF.

In the case of individual trustees, since each member of the fund is required to be a trustee of the fund, the names on the titles of every asset must be changed each time a member enters or leaves the fund. Changing the titles for every single asset owned by the fund can be a costly and time-consuming process.

When a member joins or leaves a SMSF with a corporate trustee, there is no requirement to change the title of all assets of the fund as the assets are held in the name of the corporate trustee company.

Changes in membership may occur upon marriage, divorce, death and when including children to the fund.

In addition, less documentation is required to appoint a new member to a fund with a corporate trustee compared to admitting a new member to a fund with individual trustees.

Practical problems can arise for funds with multiple individual trustees. Often share registries and broker services cannot cater for more than two names on the title of an asset or on an account name.

Even more interesting is the way the registries can deal with the death of an individual trustee. Instead of changing the title from the name of the former pair of individuals to the name of the new pair of individuals or the new corporate trustee, a two-step process is implemented because they deny the existence of the SMSF. The asset is treated as being owned jointly by the two individuals, unless specified as tenants in common, and upon death of one trustee the asset is transferred and owned solely by the remaining trustee. As a result, another off-market transfer is required to move the assets from the name of the original surviving trustee to the names of the new trustees.

Trustee Penalties

The ATO has a range of options available to deter and address instances of non-compliance by SMSF trustees including the ability to issue administrative penalties. The administrative penalty regime applies penalty units on a sliding scale to certain contraventions based on the seriousness of the breach. The penalty applies per trustee and cannot be paid for by the fund. Where the fund has a corporate trustee, all directors are jointly and severally liable to pay the total penalty amount. Where the fund has individual trustees, each trustee will be individually liable to pay the penalty amount. As such, where a fund has multiple members and an individual trustee structure the total amount payable would be four times more when there are four individual trustees compared to a corporate trustee structure with four directors.

Asset Protection

As a corporate trustee company is subject to limited liability, this may provide greater protection of personal assets. A 2011 case has highlighted the potential exposure of individual trustees and how individual trustees could be held personally liable for the actions of another trustee. The case of ‘Shail Superannuation Fund and the Commissioner of Taxation [2011] AATA 940’ involved a husband and wife acting as individual trustees. The couple separated and the husband illegally withdrew almost $3.5 million from their SMSF and left the country. The ATO fined the trustees of the fund around $1.6 million. With only the wife left as the remaining trustee in Australia, she was held personally liable for payment of the fine. It is important to note that a corporate trustee structure may not necessarily provide protection from penalties, as under the SIS Act the regulator is able to pursue any person involved in a breach of the applicable legislation.

Succession Planning

A company has an indefinite lifespan, a fund with a corporate trustee can therefore more easily be passed down from one generation to another. Having a corporate trustee also allows for a smoother and simpler transition when a member dies. If a fund with a corporate trustee has two members and one member dies the corporate trustee can continue with a single director. If an individual trustee fund has two members and one member dies, a replacement trustee would be required.

Cost considerations

The individual trustee structure does not require the establishment of another legal entity. This saves the initial establishment cost of the new company (which should be a special purpose trustee company) and the small annual ASIC levy. The special purpose trustee company does not have to register with the tax office or lodge a tax return.

Trustees will need to consider the additional upfront cost of establishing a corporate trustee versus then additional cost that will be incurred in the case of trustee changes for individual trustee and succession planning later down the track.

Of course, the question does also get asked, “can I use an existing company instead of setting up as new company to act as the SMSF trustee?”

While the superannuation law does not preclude this, it is important to consider superannuation rules. Generally only members of the SMSF are permitted to be trustees which may not suit the requirements of the other activities of the company. Additionally, it may be difficult to separate the activities and assets of the company between other roles and its role as trustee of the SMSF which could lead to a contravention of the requirement to keep the asset of the SMSF separate from assets of related parties.

Conclusion

The following conclusions can be drawn depending on the number of members in the SMSF.

Single member SMSF - cleanest approach is to have a single director company as the trustee so no other parties are involved. It is important to ensure that there is a Will which will appoint an executor as the new director of the trustee company to handle the SMSF on the member’s death.

Two member SMSF - either individual or corporate trustee structure will work, and the decision will hinge more on whether trustees wish to pay a little more for the running of the trustee company and the perceived benefits of the structure. A preference toward a corporate trustee would exist if the SMSF had real property as one of its investments

Three, four, five or six member SMSFs - while legally either trustee structure is suitable, given the practical issues it is more likely to lean towards the use of a corporate trustee. This also makes some aspects simpler if the multi-member fund ends up splitting. This could occur particularly if the members are constructed from multiple couples, who’s objectives may diverge, or parents and children. As the children become older we see them seeking greater control in the running of the SMSF.

You also may be required to use a corporate trustee if the membership exceeds four as it is not permitted to exceed four individual trustees under some state trustee Acts.

If you're a trustee or considering becoming one, the structure of your SMSF - either an individual or a corporate trustee - is one of the first important decisions to make.

Watch our free webinar

For more information on whether a corporate trustee is the right option for you and some practical guidance on how to move to a corporate trustee structure, watch the recording of our free webinar 'The benefits of a corporate trustee structure in an SMSF'. Access here.