With 30 June fast approaching, SMSF accountants and advisers must turn their attention to ensuring that superannuation pensions are fully compliant for the 2025 financial year. A proactive approach now can help avoid compliance breaches, unnecessary tax liabilities, and audit issues. Here’s a timely refresher on the key areas to review and actions to take before year-end.

1. Minimum Pension Payments

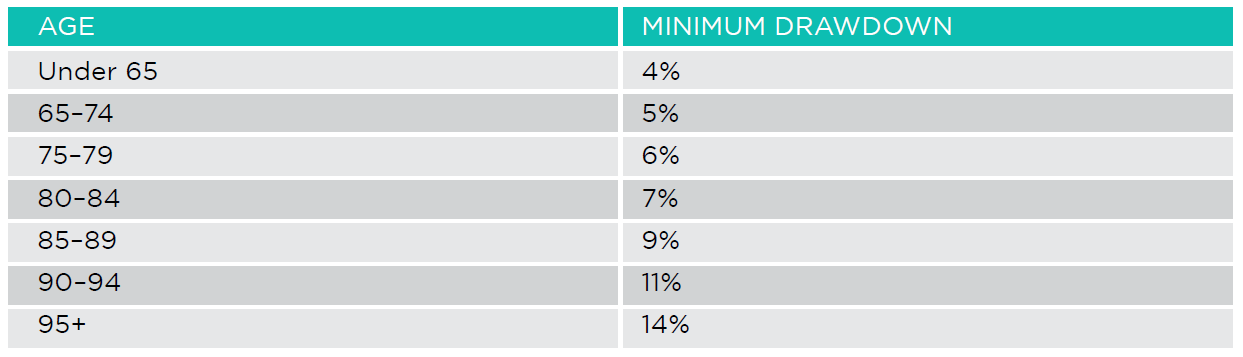

Ensure that all account-based and transition-to-retirement income streams (TRIS) meet the minimum pension drawdown requirements. The COVID-19 halving of minimums ended on 30 June 2023, so normal minimums apply for FY2025.

Failing to meet the minimum means the pension is deemed to have ceased on 1 July 2024, with earnings becoming taxable at 15% from that date. For TRIS accounts, any withdrawals made are treated as lump sum payments from preserved components, raising other compliance issues to deal with.

Tip: Check all payments made to date and calculate any shortfall. Ensure shortfalls are paid well before 30 June, and from the correct Super Fund bank account, especially where multiple accounts are involved.

2. Commutation Documentation

Where members have made lump sum commutations during the year (especially from retirement phase pensions), ensure that valid commutation requests are in place and properly documented. This is essential not only for tax compliance but for accurate Transfer Balance Account Reporting (TBAR).

Backdating commutations is not permitted, and ATO scrutiny around misuse of commutation strategies is increasing.

3. TBAR Compliance

All relevant TBAR lodgments must be up to date, especially where:

- Pensions have commenced,

- Commutations have occurred,

- Reversionary pensions have taken effect (12 months post-death).

With most SMSFs now on quarterly TBAR reporting, ensure that all events have been captured and lodged on time.

4. Transition to Retirement Income Streams (TRIS)

For members under 65 who are not retired, a TRIS must not exceed 10% of the 1 July account balance. Watch for excess payments, especially where automation or rounding errors may have occurred.

If a TRIS has become a retirement-phase pension during the year, confirm that a condition of release was validly met and recorded (e.g., retirement or turning 65). Update the status and notify the ATO via TBAR, if needed.

5. Pension Commencements and Segregation

If new pensions commenced during the year, make sure actuarial certificates (for unsegregated funds) are being arranged where needed. Consider whether segregation of assets was used during the year and ensure this was appropriately documented and reflected in the SMSF’s accounting records/minutes.

Final Tips

- Double-check pension commencement dates, balances, and drawdowns for accuracy.

- Ensure trustee resolutions or member instructions support any commutations or changes in pension status.

- Review strategies to rebalance member balances before 30 June where tax efficiency or estate planning are relevant.

Conclusion

SMSF pensions are a critical compliance area that demands early attention before year-end. Use the coming weeks to review pension accounts, verify payments, finalise documentation, and plan TBAR lodgments. A short review now can prevent significant issues down the track.