.png?sfvrsn=dbb9d1ff_0)

As we head towards the end of another financial year, it is time to consider various contribution strategies, and one of these is the use of an unallocated contributions account.

An unallocated contributions account (or 'contributions reserve' as they are sometimes called) entitles the trustee to "warehouse" contributions for up to 28 days after the end of the month in which the contribution was made. This is enshrined in the Superannuation Industry (Supervision) Regulations 1994 (SIS Reg 7.08(2)).

As explained by the Australian Taxation Office (ATO) in Taxation Ruing TR 2010/1, contributions are eligible for deductibility in the year they are received by a superannuation fund; however, they are not counted towards the member's contribution cap until they are allocated by the fund trustees to the member. Given the regulatory framework mentioned above, this can be some time after the contribution has been received.

This means if a contribution to an SMSF is received in June 2022 but not allocated to the member until July 2022, it will:

• Be eligible for deductibility in the 2021/22 financial year, but

• Count towards the relevant cap in the 2022/23 financial year.

Let's have a look at a case study to illustrate the concept.

Wayne, 65 and retired, wishes to maximise his tax-deductible contribution to super in the 2021/22 financial year to offset his assessable income. He has not used any of his concessional cap for the 2021/22 financial year.

As the concessional cap increased to $27,500 from 1 July 2021, Wayne can make a $27,500 concessional contribution in 2021/22, as well as a $27,500 concessional contribution in the month of June 2022, which will remain in an unallocated contributions account for the remainder of 2021/22 financial year, to then be allocated to him by 28 July 2022.

Wayne will be able to utilise the tax deduction of $55,000 ($27,500 + $27,500) in the year of contribution (2021/22 financial year) but will not have an excess concessional contribution, as the $27,500 contributed in June will be allocated to him by the trustees in the following year (2022/23 financial year).

If both contributions are to be made in June, it is best practice to contribute the amounts separately; so it is clear they are two distinct concessional contributions.

The carry-forward rules allow an SMSF member to make extra concessional contributions – above the general concessional contributions cap – without triggering an excess and thus having to pay extra tax.

The carry-forward arrangements involve accessing unused concessional cap amounts from 1 July 2018. An unused cap amount occurs when the concessional contributions made in a financial year were less than the member's general concessional contributions cap.

For example, Betty receives employer contributions of $14,250 in the 2021/22 financial year. An employer contribution is considered a concessional contribution and counts against the standard $27,500 concessional cap for the 2021/22 financial year. However, the difference between the two - $13,250 – can be claimed by Betty as a personal concessional contribution in the 2021/22 financial year or carried forward by Betty for up to the next five financial years to make a personal deductible contribution.

There are several key points regarding eligibility criteria for the carry-forward concessional contribution provisions:

• Betty's Total Super Balance (TSB) must be less than $500,000 as of the previous 30 June to make the contribution

• Betty must have the assessable income to offset the tax deduction

• The unused balance rolls forward for five years; it expires if not used.

Using the unallocated contributions account with the carry-forward concessional contributions cap means eligible members can make a sizeable personal deductible contribution to super and remain within their concessional contributions cap.

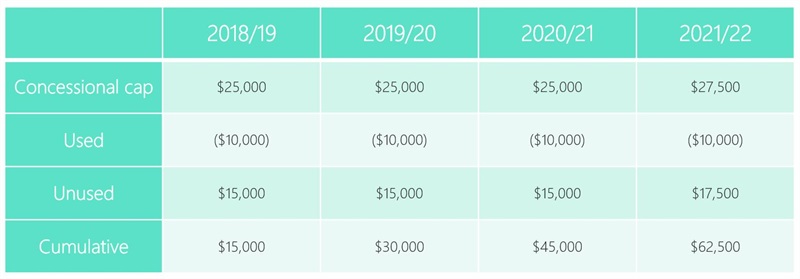

Since 1 July 2018, Snow has received employer contributions of $10,000. She has not made or received any other concessional contributions. Snow has the following carry-forward concessional contributions available:

In this current financial year, Snow incurs an assessable net capital gain of $90,000 on the sale of an investment property.

Subject to Snow's TSB being less than $500,000 as at 30 June 2021, Snow can offset the capital gain of $90,000 by using her carry-forward concessional contribution ($45,000), the unused concessional contribution cap in 2021/22 ($17,500) and the concessional contribution cap for 2022/23 ($27,500) utilising the unallocated contributions account strategy.

Snow would need to ensure the $27,500 is contributed in June of 2022, so it can be allocated by the fund trustees to her by 28 July 2022 – the next financial year. This would then mean Snow could not make any concessional contributions in the 2022/23 financial year and maybe in excess of her concessional cap if receiving employer contributions.

Where a member of an SMSF wishes to utilise such a strategy, the following are essential to ensure the strategy is successful:

• The fund's trust deed allows for an unallocated contributions account strategy.

• The contribution is allocated within the 28-day requirement.

• There must be evidence of the receipt of the contribution.

• A Trustee Resolution detailing the trustee's decision to defer the allocation of the contribution until the next financial year as per Regulation 7.08(2) of the SIS Regs

• A Section 290-170 "Notice of intent to claim or vary a tax deduction for personal super contributions" form [NAT 71121] (this is an ATO form required to claim personal deductible contributions).

Trustees should also ensure the ATO is notified of the use of the strategy by completing and lodging a "Request to Adjust Concessional Contributions" [NAT 74851] by the time the fund's SMSF Annual Return and the individual's income tax return are lodged. This is important, otherwise, the contribution will be reported in the SMSF Annual Return in the year in which it was received, which may mean the ATO may believe the member has exceeded their concessional contributions for the year.

.png?sfvrsn=f5af2bc0_0)

For fortnightly insights, follow our podcast SMSF Adventures with SuperConcepts hosted by Jessica Griffith as she speaks to some of the greatest minds in the industry, to deliver the information that matters.

Follow the show on Spotify or Apple Podcast.

To learn more about how our range of SMSF services phone us on 1300 023 170 or request a call back.

Alternatively click through to view our range of services for trustees, accountants and advisers.