You can’t make an omelette without breaking an egg, so the saying goes. But when it comes to super you can’t start a pension without using your accumulation balance. So what do you need to do to get a pension going?

There are just two types of pensions that you can start from your SMSF - an account based pension and a transition to retirement income stream (TRIS). They both have similar features but a TRIS has restrictions on drawing lump sums and is counted against your Transfer Balance Cap once you have retired after reaching preservation age, currently age 58, or when you reach age 65, whichever comes first.

The first thing you need to do is work out whether you are eligible to start a pension. You can pay a pension if you’ve retired for superannuation purposes, reached age 65 or met another condition of release such as permanent disability, or are terminally ill. A TRIS can commence once you have reached your preservation age which is currently 58, but from 1 July 2022 preservation age will increase to age 59.

The next step is to value the assets of your SMSF which are required to meet the ATO valuation guidelines. The starting amount for the pension should be based on the market value of the fund’s investments when the pension commences. For ongoing pensions, you will use the value of the fund’s investments as at 1 July in the financial year. The amount used to commence the pension will count towards your Transfer Balance Cap of between $1.6 and $1.7 million (see more below). Any valuation of the fund assets should be based on objective and supportable data. For example, listed shares are readily available from the media or stock exchange. However, private company shares, and units in a private unit trust as well as real estate, artworks, and collectibles may require an independent valuation from someone who is qualified.

The amount used to start your pension is fixed at the time it commences. It is not possible to add contributions to your pension balance or transfer amounts from your accumulation account without first stopping your pension. The combined starting value of any pensions you have in retirement phase is limited to your Transfer Balance Cap. Your Transfer Balance Cap will be an amount between $1.6 and $1.7 million and depend on whether you commenced a retirement phase pension prior to 1 July 2021. As an example, anyone who commenced a pension from their SMSF for the first time from 1 July 2021 will have a Transfer Balance Cap of $1.7 million. However, anyone who commenced a pension before that time will have a Transfer Balance Cap of at least $1.6 million.

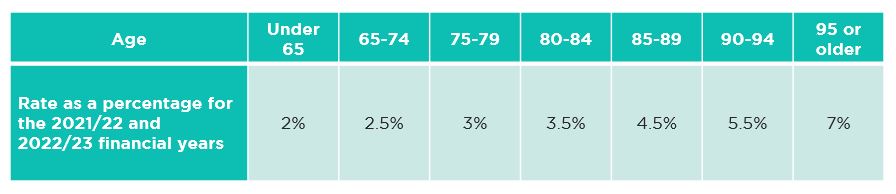

There is a minimum annual pension amount you need to pay each year. For the 2021/22 and 2022/23 financial years, the minimum pension required to be paid as a percentage of your opening balance is:

Source: ATO

Before commencing your pension it is advisable to write to the trustee to include details of:

.png?sfvrsn=f5af2bc0_0)

For fortnightly insights, follow our podcast SMSF Adventures with SuperConcepts hosted by Jessica Griffith as she speaks to some of the greatest minds in the industry, to deliver the information that matters.

Follow the show on Spotify or Apple Podcast.

To learn more about how our range of SMSF services phone us on 1300 023 170 or request a call back.

Alternatively click through to view our range of services for trustees, accountants and advisers.