By Anthony Cullen

Superannuation benefit payments in a COVID 19 environment

As a result of the economic impact of COVID 19 the Federal Government have announced a series of initiatives to help cushion the blow of these extraordinary times. As it did in the wake of the Global Financial Crisis, the Government has reduced the minimum draw-down requirements on some pensions, which will be the main focus of this article.

Dealing with Account Based Pensions

On 24 March 2020 the Government’s Coronavirus Economic Response Package Omnibus Act 2020 received royal assent. Schedule 10 of the Act relates to superannuation drawdowns and ultimately halves the normal drawdown requirements as stated in various Schedules contained within the Superannuation Industry (Supervision) Regulations 1994. The most common being Schedule 7, dealing with Account Based Pension (ABP) requirements.

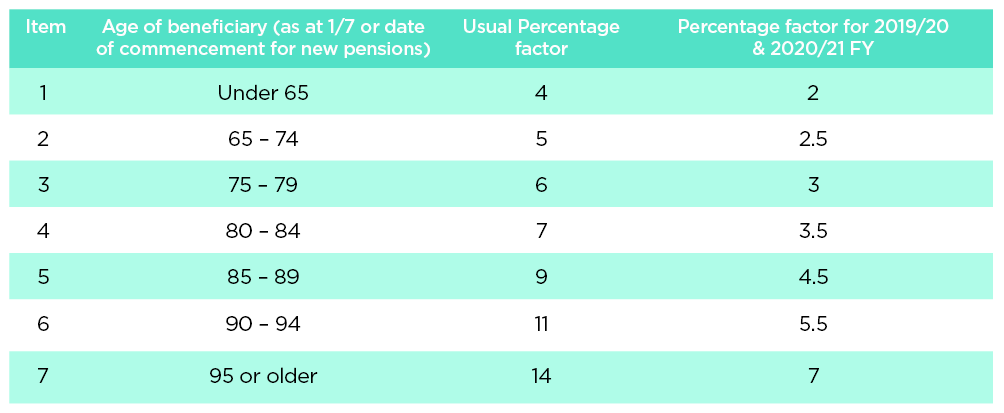

In relation to ABPs, minimum income stream benefits are determined by multiplying the balance of the member’s ABP interest by the relevant pension factor, per the below table.

Subparagraph 5 of the schedule states that the amount determined is to be rounded to the nearest 10 whole dollar (with amounts ended in exactly $5 being rounded up). Although it may be tempting to do so, simply halving the minimum amount that may have previously been calculated may result in an incorrect amount being withdrawn. The correct application of the law is to halve the percentage requirement used in the calculations rather than the dollar amount determined as the minimum requirement.

Calculation Example

Take George for example. On 1 July 2019, George was 75 years of age, with an ABP balance of $585,233. Based on the table above, his default drawdown would be 6%, being $35,110 (rounded). If we were to half this amount, we could potentially be telling George he now has to draw $17,555. However, if we apply the lower percentage requirement prior to any rounding we would be telling George his re-calculated minimum is $17,560.

Avoiding a breach

Although most would look at this variance as immaterial it still has the potential to create a situation where the pension standards have been breached as a result of not paying the minimum pension. It is possible that the 1/12 rule may be available, but what if it isn’t? Even if it is, do we want to be using our one and only option to use it on this? Some may argue this is just a rounding issue. Nonetheless, it’s an issue that can be avoided if the rounding is applied at the right time.

These measures also apply to the following pensions:

Where these pensions have a maximum withdrawal limit, there is no change to calculating said maximum.

Withdrawals from complying pensions that are determined by an actuary cannot be halved under these temporary provisions. Pension payment requirements will continue to be in accordance with the original expectations.

Adjusting prior payments

Where a member has been receiving regular pension payments throughout this income year, with the minimum drawdown rates now reduced, it’s entirely possible they may have already received more than the required minimum pension payment amount for this income year. We have received numerous questions about whether it’s possible to re-classify pension payment amounts that have already been paid, and which exceed the reduced minimum drawdown amount, as lump sum withdrawals rather than pension payments. This is due to the fact there may be benefits from having withdrawals treated as lump sums.

Having payments treated as lumps sums will impact on their Transfer Balance Account (TBA) and may free up space within their Transfer Balance Cap (TBC), potentially allowing for further strategies in the future. Further to this, for those members under the age of 60, accessing the lump sum low rate cap may provide greater tax benefits than receiving pension payments for the individual.

What to consider before making adjustments

There are several concerns to be contemplated before implementing such a strategy. As regulators of SMSFs, the ATOs view on changing the treatment of payments is an important starting point. The below Q&A has been taken directly from the ATOs Frequently Asked Questions page dealing with COVID 19 and superannuation:

Question: I am retired and receive an account-based pension from my SMSF. My account-based pension has already paid me more than the reduced minimum annual payment required for the 2019–20 financial year. Is the amount over the minimum considered superannuation lump sum amounts?

Answer: Pension payments that you have already received cannot be re-categorised. Accordingly, payments made from your account-based pension in excess of the new reduced minimum annual payment required for the 2019–20 financial year are pension payments (that is, superannuation income stream benefits) for the year and not superannuation lump sums.

Further to this, the following needs to be considered before attempting to make any adjustments to prior payments:

Any benefit payments that were previously classified as pension payments prior to 25 March 2020, were made based on the law at that point in time, that is, in accordance with the default percentage factors. In the event of an audit, it may be difficult to justify a claim of meeting the reduced minimum requirements before the law had been changed.

Example

Let’s return to George. In order to meet his original minimum ($35,110) George was receiving a monthly drawdown of $2,926 on the first day of each month. From 1 July 2019, to the date of Royal Assent (24 March 2020), George has received payments totaling $26,334. As this amount exceeds George’s reduced minimum drawdown amount of $17,560, he is not required to withdraw any further amounts for the remainder of 2019-20.

Assuming George continues to receive the monthly payments, he may look at the potential benefits of treating the remaining payments for the year as lump sum benefits. Despite having met the reduce minimum after receiving his pension in January, what George is unable to do is have the February, March or any previous month’s pension payments re-classified. They must remain as pension payments.

Where the pension member also has an accumulation account in the fund, and they have unrestricted access to that account, it may be tempting to reclassify pension payments in excess of the new reduced drawdown amount as lump sum withdrawals from the accumulation account. This will have the effect of increasing the fund’s exempt current pension income deduction. Once again, this reclassification cannot occur if the documentation on file supports the fact that the payment was a pension payment.

One final point on pension payments; they must be paid in cash. As of 1 July 2017, lump sum payments are no longer able to be used to meet minimum pension requirements. As the end of the 2019-20 financial year approaches, and even though the minimum drawdown rates have been reduced, if the new reduced minimum pension amount has not yet been paid, and the cash holdings and/or cashflow of the fund have decreased (because for example the fund’s investment income has reduced as a result of the COVID-19) it may be prudent to start considering how payments will be funded prior to the end of the year now.

Temporary Early Access to Super (TEAS)

As part of the application process, superannuation members are required to certify that they satisfy the eligibility criteria. For further details about the eligibility criteria please refer to our previous article on accessing your super here. That article explores, not only TEAS but other conditions of release that may provide additional options to accessing superannuation.

Applications can be completed via a member’s myGov account. If the member doesn’t have a myGov account or cannot access it, applications can be completed over the phone by contacting the ATO. Although members do not need to supply any supporting evidence of eligibility as part of their application, they will be required to maintain it on file in case they are asked to produce it at a later date.

After the member has verified their identity, they will see a list of funds, along with the available balance in each account, that they can select to access benefits from. In the case of a new SMSF, which has yet to lodge their first annual return with the ATO, no balance will appear but that doesn’t preclude the member requesting an amount to be withdrawn from the SMSF. In this situation, the determination issued by the ATO will stipulate the amount that can be withdrawn from the SMSF and it will be up to the trustees of the SMSF to determine if there are sufficient funds in the member’s account. Members can choose up to five accounts but are limited to only one application in this financial year, and another application in the next financial year, as long as the application is made before 24 September 2020. Regardless of how many accounts are chosen, the maximum amount that can be accessed is $10,000 per application.

What does this mean for temporary residents?

Recent changes mean temporary residents may also be eligible to access their super under TEAS, although they will only have the one opportunity to access their super in the 2019-20 financial year. Temporary residents must satisfy one of the following:

The ATO expect to issue notices of acceptance or rejection within four days but depending on volumes of applications may do so within one to two days. The main difference between SMSF and APRA fund members is that release authorities for APRA funds will be sent directly to the fund, whereas SMSF members will personally receive any notifications from the ATO. The member is then required to supply the release authority to the trustees, in most circumstances this will be themselves.

Receiving a valid determination

Once a trustee receives a valid determination it is expected that payments are made as soon as practicable as a single lump sum amount not exceeding the amount stated on the determination. A lower amount may be paid if the member’s account balance is insufficient to cover the stated amount or the member contacts the trustees and requests a lower amount. However, they will be unable to request a top up of the remaining amount at a later date.

It is important to note that the application process must be followed and a favourable determination must be issued by the ATO before members are able to access their SMSF benefits. Accessing benefits without meeting a condition of release may result in action being taken for illegal early access of benefits.

We are aware of strategies which involve members accessing their superannuation savings early under the TEAS and then recontributing the withdrawn amount back to their fund as either a salary sacrifice contribution or as a personal deductible contribution. The ATO has asked individuals, tax agents and businesses to be mindful that it is not acceptable to apply for relief payments where eligibility may be questionable. Applications for relief through stimulus measures which are based on artificial arrangements will see the ATO take swift action.

To stay on top of the latest news in relation to COVID 19 and SMSFs keep an eye on our articles on the SuperConcepts website here. While you’re there why not sign up to our newsletters. We’ve also released a series of eBooks that are regularly updated with answers to common questions we are receiving on the impacts of COVID 19. These can be found here.