By Graeme Colley

Okay, so you want a comfortable retirement, which is totally understandable. But do you have any idea of the savings required?

Here’s some research from the University of New South Wales: to receive the equivalent of an average wage in retirement, approx. $85,000 p.a. before tax, you’ll need to save about 15 to 20 times that amount – $1.3m to $1.7m at today’s prices.

The Association of Superannuation Funds of Australia has also looked at this question. As opposed to total savings, they focus on income requirements for a ‘comfortable’ lifestyle, with their current estimates being $43,601 p.a. for a single person and $61,522 for a couple.1 And if you accept their estimates, then you’d want to avoid relying on social security alone, with the Age Pension currently paying $24,081 p.a. for singles and $36,301 for couples.2

Let’s say you are 59 and your partner is 57, and you both intend to receive a ‘comfortable’ amount in retirement, which is about $61,500 p.a. after tax. At those ages it could be expected that on average you will both live into your mid 80s or later. In addition, it is reasonable to assume that:

While these assumptions may be considered unusual in the current economic environment of low inflation and low interest rates, we are considering a long-term horizon of 40 years or even longer.

If we use these assumptions, it is estimated that the total amount required in today’s money is slightly over $1.141 million.

Having estimated the amount required, we need to work out how it can be accumulated. Important considerations include: how determined you are to save for retirement; the benefit of compound interest and; the age you start saving. Let’s look at the difference if you started saving for retirement at 20 compared to 50.

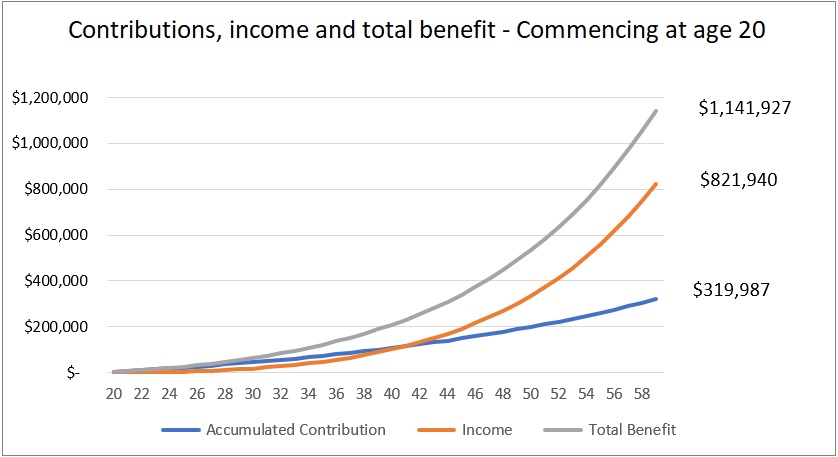

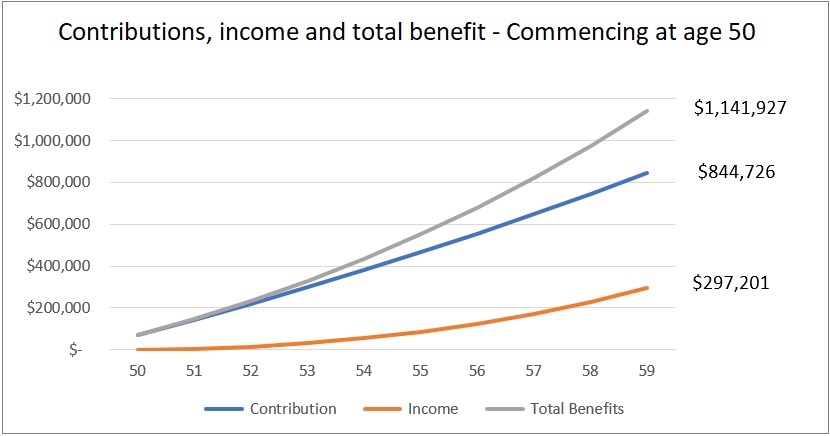

By beginning at age 20 – and to accumulate about $1.141 million – the amount you need to contribute each year starts at about $3,367 p.a. If you begin saving at 50, the equivalent figure is $70,358 p.a.

The advantage of starting at age 20 compared to 50 can be illustrated in the two following tables. These show how much of the final amount accumulated in super will be made up of the contributions themselves and corresponding investment income. Starting at age 20 means a greater proportion of the final benefit will be investment income.

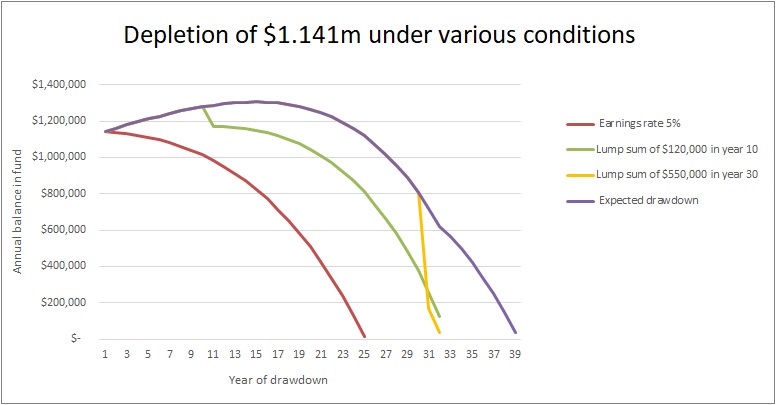

The hardest question to answer is ‘how long will your super last’, which can be influenced by many factors including unforeseen drawdowns, emergencies and market forces. For instance, you may need to withdraw an unexpected lump sum soon after retiring to pay for age care accommodation or other health needs. Or there be significant long-term changes to rates of return on investments, or inflation may nibble away on the value of your super.

It is possible that you or your partner may die earlier than expected, leaving your remaining super to your surviving spouse of other beneficiaries. The amount required to live on and the timing of the payments are not easy to predict.

Assuming a target savings amount of $1.141m, let’s see how long the money would last for based on an expected drawdown of $61,500 p.a. indexed to CPI plus three additional variants:

From this chart we can see that the quickest depletion is caused by a lower-than-expected earnings rate (5% p.a. instead of 7% p.a.), with a nil balance being reached by the 25th year post-retirement.

If $550,000 is drawn down in the 30th year, the amount in superannuation would run out in year 34.

And if $120,000 is withdrawn in year 10, the amount accumulated would last to the 35th year.

1. Association of Superannuation Funds of Australia, ASFA Retirement Standard, available at www.superannuation.asn.au/resources/retirement-standard (data for June quarter 2019, national).

2. Department of Human Services, Payment Rates for Age Pension, available at www.humanservices.gov.au/customer/enablers/payment-rates-age-pension.