By Mark Ellem

Scenarios will arise where the value of the asset under an LRBA will be less than the outstanding loan balance. Given the requirement, under SIS regulation 8.02B, to disclose fund assets at ‘market value’ and the nature of a limited recourse loan, consideration needs to be given to how the LRBA will be disclosed in the annual financial statements. Let’s consider the following example:

An SMSF acquired a property via an LRBA for $800,000 with an initial loan amount of $480,000 (an LVR of 60%). Due to recent significant downturn in property prices in the area, the property is now valued at $350,000, however, the amount owing on the loan stands at $400,000.

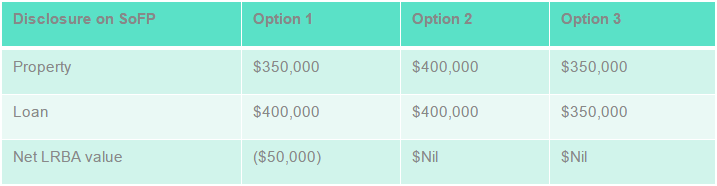

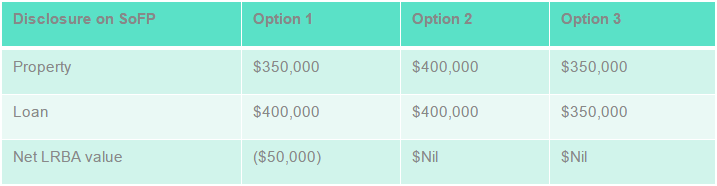

Which of the following options should be adopted for disclosure of the LRBA in the SMSF’s annual financial statements?

Option 1

Option 1 – discloses the property at current ‘market value’ and the loan at the outstanding balance. However, as the loan is a limited recourse loan, the lender is effectively only entitled to recover the loan, from the SMSF, to the extent of the value of the property (there may be personal guarantees that the lender can call upon). Consequently, the negative effect of $50,000 on the fund’s net assets and consequently on member benefits would not be regarded as correct disclosure.

Option 2 – The value of the property is increased to the value of the loan to circumvent the negative $50,000 effect on fund net assets and member benefits, as outlined in Option 1. However, this would mean that the asset is not disclosed at ‘market value’ and would be a breach of SIS regulation 8.02B.

Option 3 – This reduces the disclosed amount of the loan to value of the property, to reflect the limited recourse nature of the loan. Whilst the loan is not reported as the actual amount outstanding, this would not contravene SIS regulation 8.02B, as this regulation only requires fund assets to be disclosed at ‘market value’. An appropriate note disclosure would be prudent to report the actual amount of the loan outstanding and include comment that the loan is a limited recourse loan and consequently recovery of debt is limited to the value of the property under the LRBA.