By Craig Stone

By Craig Stone

General Manager, Quality & Technical Services

Please explain: Transfer Balance Account Reporting (TBAR)

The ATO keeps tracks of how much a superannuation member moves into the tax-free pension phase – it is known as your Transfer Balance Account (TBA).

When the rules were first introduced on 1 July 2017, each individual was allowed a Cap of $1.6m, across all their superannuation funds. With indexation, the Cap has increased on 1 July 2023 to be currently $1.9m.

What events need to be reported under TBAR?

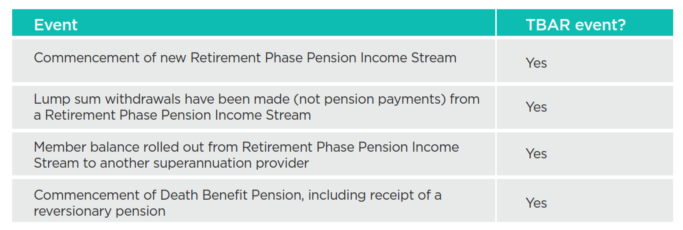

The table below provides common examples of the events that affects a member’s TBA:

For a full list of the events that must be reported to the ATO, please visit the

ATO website.

When do trustees need to report?

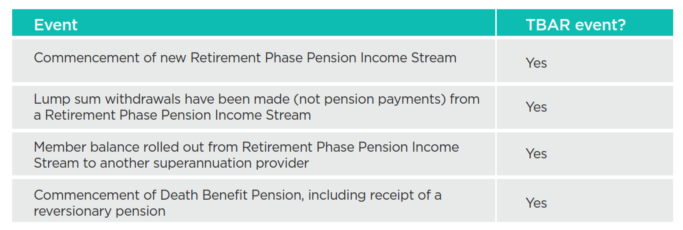

Effective 1 July 2023, the ATO aligned the Transfer Balance Account Reporting to other quarterly reporting already being done by some taxpayers (e.g. Business Activity Statements). The next reporting date is 28 October, 2023; the following table shows the reporting dates for the FY24:

Late lodgment penalties

Although no penalties for failure to lodge on time have been issued yet, the ATO has the systems in place to charge one penalty unit (current valued at $313) for each period of 28 days (or part thereof) that a report is lodged late, up to a maximum of 5 penalty units.

Now that the ATO has successfully rolled out the streamlined reporting regime for all SMSFs, it isn’t difficult to see late lodgment penalties being imposed in due course.

Action required

All trustees are ultimately responsible for the compliance of their SMSF, and this includes on-time Transfer Balance Account reporting. SuperConcepts' Client Service Manager will work with you to ensure you satisfy the compliance requirements by attending to on-time lodgment going forward.

Please reach out if you have any specific questions in relation to your situation.