By Anthony Cullen

There has been a lot of interest and discussions relating to indexation over the past few months. From a superannuation point of view, the relevant statistics that we have been eagerly anticipating are the Consumer Price Index (CPI) and the Average Weekly Ordinary Times Earnings (AWOTE).

In late January 2021 the All Groups CPI figure was released confirming a factor that will result in an indexation of the General Transfer Balance Cap as of 1 July 2021. From 1 July 2017 we have lived in a world that limits the amount a superannuation member can transfer from being in the accumulation phase to being in retirement phase. The starting point, as at that date, was $1.6 million, and is still applicable in the 2020 – 2021 financial year.

However, with the latest CPI figures we will see the first $100,000 increase in this value to $1.7 million, for some. We have become accustom to the concept of a Transfer Balance Cap (TBC) over the past few years. With this increase, we now need to consider the concepts of a General Transfer Balance Cap (GTBC) and Personal Transfer Balance Caps (PTBC). For further details on this, please read our recent article on the topic, that can be found here.

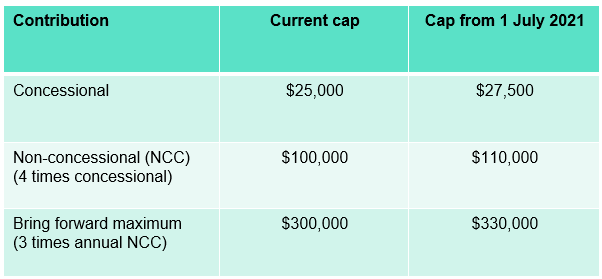

On 25 February 2021 the AWOTE figures were released. Based on the increase, we will also see an increase in the contribution caps from 1 July 2021 as follows:

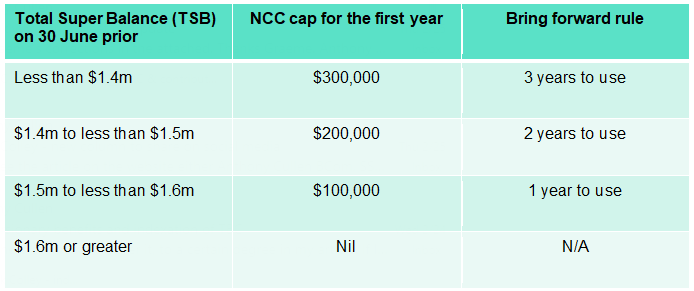

It is worth noting that there is a link between the GTBC, the NCC cap and the bring forward rule. Most people will be familiar with the below table, as it (or a similar variant) has been used widely by the industry since July 1, 2017.

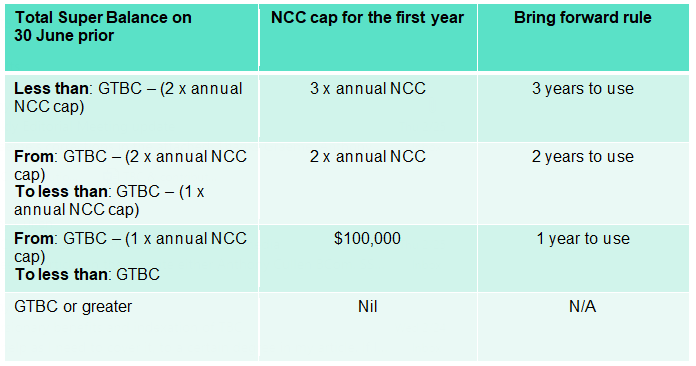

With the increases resulting from indexation, these figures will change. Before listing the changes, the following table reflects how the Income Tax Assessment Act 1997 determines the details. By showing this, we can get a better understanding of the impact of indexation not only for this year, but for the future.

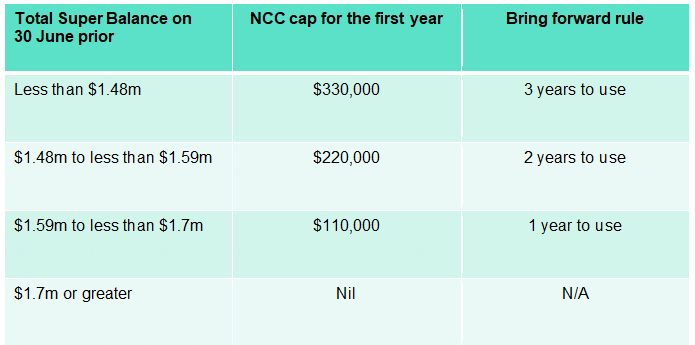

Taking into account indexation as at 1 July 2021, the brackets for the bring forward provisions are reflected in the below table (until further indexing of either one or both of the caps).

The year in which the bring forward rule is triggered will continue to determine what a member may contribute, and in what timeframe. For example, if somebody with a TSB of $1.45m on 30 June 2020 triggers the bring forward rule in the 2020 – 2021 financial year, they will have two years to contribute up to $200,000. This will not change as a result of the indexing of the caps.

If that same person has a TSB of $1.45m on 30 June 2021 and does not trigger the bring forward rule until the 2021 – 2022, then they would be eligible to contribute up to $330,000 over three years.

There are some TSB thresholds that are not indexed and will remain at their current levels, such as:

These thresholds do not currently have any legislative mechanisms to be indexed or changed over time. It will take amendments to the law to see this occur. If the $500,000 small business retirement exemption is anything to go by, this may not happen any time soon.

Certainty around the combination of increases to both the contributions cap and the GTBC is welcome news and provides trustees and their advisers the next few months to contemplate their contribution and pension strategies in light of the changes.