Ready to upskill and give SMSF advice? Register for SuperConcepts SMSF Specialist Course today.

Register today

Cookies and tracking on our website

We use cookies to provide you with a customised experience, improve services and may be used for marketing.

More details can be found

here.

You can turn off your cookies collection and tracking in your browser settings.

You are currently on:

- Home

- SMSF Education

- SMSF 101

- Understanding SMSF

- Investment Strategy

Investment Strategy

All SMSFs are required to have a written investment strategy. The investment strategy starts with the investment objectives and then sets out the parameters for the investments usually including an asset allocation. Other factors that the investment strategy should take into account include:

- Risk vs return

- Diversification

- Liquidity needs (how easily and quickly the assets can be converted to cash)

- Ability to discharge liabilities as they fall due

- Insurance needs of the members

The investment strategy should be based on the objectives, needs, and preferences of each SMSF member. Factors to consider include their age, their retirement needs, and their attitude towards risk. The strategy should explain how the fund’s investments meet each member’s retirement objectives.

A review of the investment strategy should be conducted on a regular basis to ensure it continues to reflect the members’ circumstances. All decisions should be documented, including the decision to make no changes.

Investment Options

When it comes to investment options for SMSFs, you get a lot of choices. Your fund can invest in:

- cash

- term deposits

- direct shares

- managed funds

- property and more.

As well as a wide range of investment choices, you get to choose the mix of investments for your fund through an investment strategy.

Below are a few things to consider when you’re planning your investment strategy;

Diversity

Diversification is about investing in a variety of assets so that no single asset drives the performance and risk of an investment portfolio. It can mean that positively performing investments balance out the negatively performing ones.

This can help lower the risk across a portfolio and smooth out investment returns over time. While this may not lead to huge gains, the effect of big losses may not be felt as strongly.

Liquidity

Although you’re generally unable to access your super until retirement it’s still important to consider how accessible cash is in an investment (e.g. an at-call deposit account is very liquid, while the property is not).

SMSFs can have a combination of liquid and illiquid assets so you may need to think about cash flow and when you’ll need access to your money. For example, if a member passes away, the trustees may need to access cash within the SMSF to pay dependants or the estate of the deceased.

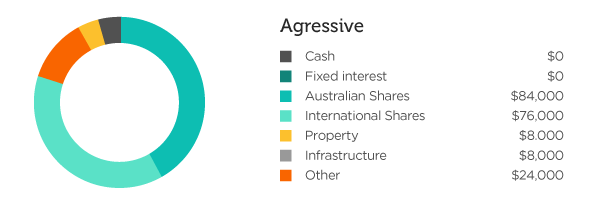

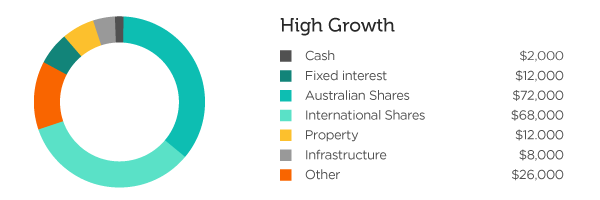

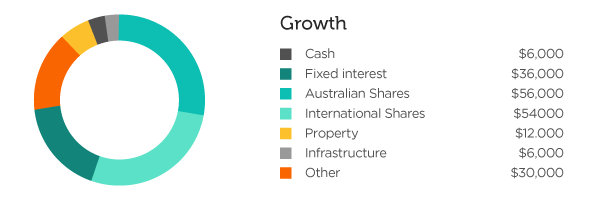

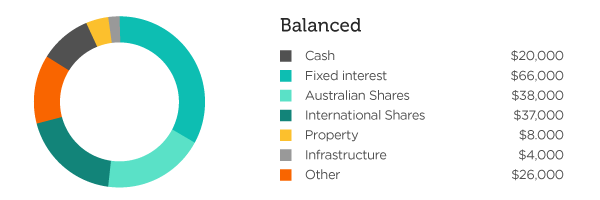

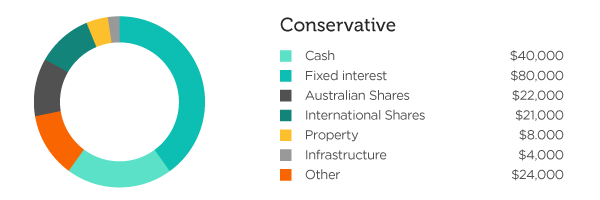

Asset allocation profiles

Asset allocation is how your investment portfolio is spread across different investments. Asset allocation can often involve considering the split between growth investments (generally more aggressive) and interest-bearing investments (generally more conservative).

Based on a minimum balance of $200,000 and as an example, a diversified portfolio might invest the following amounts in each asset class.

BACK TO: Types of investments

UP NEXT: Taxation

Keen to learn more?

Need help setting up your SMSF?

To receive a call back please complete all fields