By Graeme Colley

The start of a new financial year always brings new rules for super funds with it. Sometimes there are lots of wide-reaching changes and in other years there are just a few. For the 2020/21 financial year the two changes are the abolition of the work test for anyone aged 66 and 67 wishing to make personal non-concessional contributions, and an extension of spouse contributions from age 70 to 75. But we are waiting for the change that will allow access to the bring forward rule. The continuation of the 50 per cent reduction in the minimum pension rate for account-based pensions due to the COVID – 19 pandemic will apply for the whole year.

Abolition of the work test to age 67

Until 30 June 2020 there was no need for a member to satisfy a work test for personal concessional and non-concessional contributions before reaching age 65. However, once they reached 65 in the financial year a work test of 40 hours in 30 consecutive days was required to be met at some time during that year and prior to the contribution being accepted. Providing the work test is met in a financial year, personal concessional or non-concessional contributions can be accepted up to 28 days after the month in which the person reaches age 75. But there are exceptions to the work test where personal contributions are made in the year after ceasing work or for purposes of downsizer contributions.

From 1 July 2020 it is now possible to make personal contributions without needing to satisfy a work test until age 67. If the member reaches age 67 during the financial year, personal contributions can still be made prior to reaching that age, but a work test must be met at any time prior to the contribution being made, in that financial year.

Example

Phillip is age 66 on 1 July 2020 and will turn 67 on 23 October 2020. His total super balance on 30 June 2020 was $875,000 and he worked 40 hours in the first week of September 2019. It is possible for him to make concessional and non-concessional contributions to his super fund without the need to meet the work test prior to his 67th birthday. But he will only be able to make contributions after he reaches 67 if he has worked at least 40 hours in 30 consecutive days. As he worked 40 hours in the first week of September, he is able to make personal contributions.

Ceasing Work Contributions

Ceasing work contributions are permitted to be made on a once only basis after the member has reached 67, previously age 65. Personal contributions can be made on a once off basis in the financial year after work has ceased and the person has a total super balance of less than $300,000 on 30 June in the previous financial year. These contributions can be accepted by the fund up to 28 days after the month in which the person reaches 75.

Example

Cynthia retired from working when she turned 68 on 1 June 2020. On 30 June in the previous financial year her total super balance was $250,000. Although she will not be working in the 2020/21 financial year, she will be able to make personal concessional and/or non-concessional contributions in the 2020/21 financial year - the year after she retired. This concession is available on a once only basis.

Downsizer Contributions

Downsizer contributions can made after the sale of a person’s main residence, as described for Capital Gains Tax (CGT) purposes, which they have owned for at least 10 years. To be eligible the person must be 65 or older and a contribution of up to $300,000 must be made within 90 days of the sale. The person’s spouse may also be eligible to contribute up to $300,000 if they are 65 or older. There is no upper age limit applying to downsizer contributions or any work test that applies.

Example

Bev and Howard are a couple and Howard has owned the house they have lived in since 2005. They decide to sell the house and go for a tree change in the country. They are both over 65 and decide to use some of the proceeds from the sale as a downsizer contribution to super. A downsizer contribution of $200,000 is made by each of them to their SMSF and the rest is used to purchase a new home. The downsizer contribution needs to be made within 90 days of the sale of their home being finalised.

Employer Contributions

When it comes to employer contributions for anyone 65 or older, there are no work tests or age limits for compulsory employer contributions such as superannuation guarantee contributions or those made under an industrial award. But a work test must be met if the employee wishes to salary sacrifice to super and they are unable to be made 28 days after the month in which the employee reached age 75.

Example

Marion, who is 74, earns $100,000 p.a. and her employer makes a super guarantee contribution of $9,500 for her during the year. She decides to salary sacrifice $10,000 to super. The amount Marion has salary sacrificed to super will need to be contributed by her employer within 28 days in the month after Marion reaches age 75 otherwise it will be refunded from her superannuation fund. The amount made by Marion’s employer will be accepted by her fund irrespective of her age.

Access to the bring forward rules from 1 July 2020

It is possible for anyone who is under 65 to trigger the bring forward rule which allows up to two year’s non-concessional contributions to be made over a fixed period. The period commences from the year in which the person makes a non-concessional contribution that is greater than the standard annual amount of $100,000.

Whether a person has access to triggering the bring forward rule depends on their total superannuation balance on 30 June in the previous financial year. For anyone with a total super balance of less than $1.4 million they are able to bring forward up to two year’s standard non-concessional contribution and anyone with a total super balance of between $1.4 and $1.5 million is able to bring forward up to one year’s standard non-concessional contribution. Once a person has a total super balance of between $1.5 and $1.6 million only the standard non-concessional contribution is available and there is no bring forward amount With a total super balance of $1.6 million or more, it is not possible to make a non-concessional contribution without incurring a tax and interest rate penalty.

It was announced in the 2018 Federal Budget that the bring forward rules would be amended to apply to anyone who was under 67 on 1 July in a financial year. Legislation to bring this change about is included in the Treasury Laws Amendment (More Flexible Superannuation) Bill 2020 which is currently in the House of Representatives. As parliament resumes in early August, the bill has a way to go prior to becoming law. It is expected that the legislation will pass as the amendment is not politically sensitive. So where are we now with contributions for anyone 65 or older with the start of the 2020/21 financial year?

Those fund members in the 65 to 66 age bracket are in a bit of a dilemma until the time the passage of the legislation is clear. From a practical point of view it is only those members with a total superannuation balance of less than $1.5 million as at 30 June 2019 or 30 June 2020 who will be impacted if they wish to maximise non-concessional contributions by using the bring forward rule.

Example

Rose, if currently 65, would have access to the bring forward rule of at least one year standard non-concessional contribution if her total super balance is less than $1.5 million on 30 June 2019. If she contributes more than the standard non-concessional contribution of $100,000, the bring forward rule is triggered and she can make the relevant contributions over a two or three year period depending on her total super balance. If she makes the contributions prior to reaching age 67, the fund can continue to accept the contributions without requiring the member to meet the work test.

However, in contrast, if Rose is aged 66 or 67, she won’t be able to trigger the bring forward rule as she was older than 65 on 1 July in the 2020/21 financial year. This will limit the maximum amount of non-concessional contribution to $100,000 without penalty. However, the consolation is that there is no requirement for Rose to meet the work test unless she wishes to make personal contributions in the financial year after she reaches 67.

Spouse contributions and the tax offset

It is possible to make contributions for an eligible spouse which are treated as non-concessional contributions and counted against the spouse’s non-concessional contribution cap. If the spouse has an adjusted income of less than $37,000 it is possible for the contributor spouse to receive a tax offset of up to 18 per cent on the first $3,000 of any non-concessional spouse contribution. The tax offset amount phases out between $37,000 and $40,000 on a dollar for dollar basis.

Until 30 June 2020, it was only possible to make spouse contributions up until age 70. Between age 65 and 70 the spouse was required to meet the work test of 40 hours in 30 consecutive days for the year in which the contribution was made. However, from 1 July 2020 this has now been extended to apply for spouse contributions made between 67, and 28 days in the month after the spouse reaches 75, which puts it in line with other personal superannuation contributions. The work test must be met prior to spouse contributions being made to the fund.

Example

Mick wishes to make a spouse contribution for his spouse Jo who is 72, works as a florist and has an adjusted taxable income of $30,000. Mick decides to contribute $100,000 for her. As Jo’s adjusted taxable income is less than the tax offset threshold Mick will be eligible to receive a tax offset of 18 per cent of the first $3,000 which is $540 against his income tax assessment for the year.

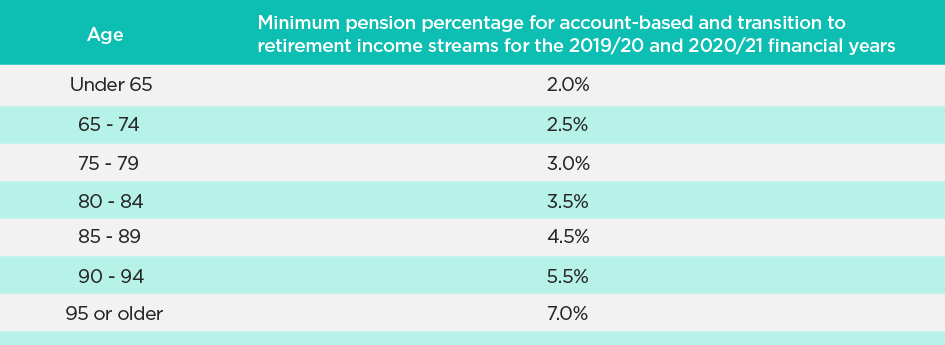

Reduction in minimum pensions for account-based pensions

In late March 2020, the government amended the minimum percentage required to be paid for account-based pensions by 50%. This meant that account based pensions, transition to retirement pensions and market linked income streams would have their minimum pension percentage reduced by 50 per cent for the 2019/20 and 2020/21 financial years.

Here are the reduced percentages that apply:

The minimum amount for market linked income streams is reduced to 45 per cent of the amount calculated under the formula in Schedule 6 of the Superannuation Industry Supervision) Regulations 1994.

What Next?

The extension of the work test exemptions to age 67 for personal superannuation contributions has been a bonus in these difficult times as well as the extension of the age at which spouse contributions can be made. However, we wait with anticipation for the extension of the bring forward rule to age 67 to become law when parliament resumes in the next few months.