By Graeme Colley

Whether your super will last the distance is a difficult question. The total amount needed to sustain your retirement depends on many factors including investment returns, your general spending pattern and your approach to unforeseen events. In this case study we’ll look at how Nick’s super would track under various conditions.

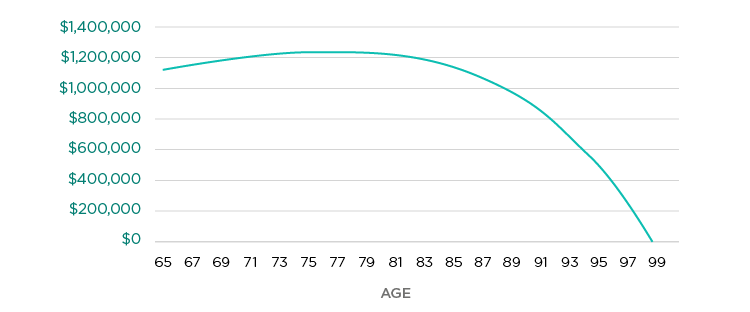

Nick is 65 and has an SMSF balance of $1.2m. He’s decided to commence a pension of $60,000 which will be tax-free and increase each year equivalent to the Consumer Price Index (CPI). The assumptions are that CPI is 3% p.a. and that the fund’s long-term earnings rate is 7% p.a. Here’s how Nick’s super would track if all went to plan, showing an income well into his late 90s.

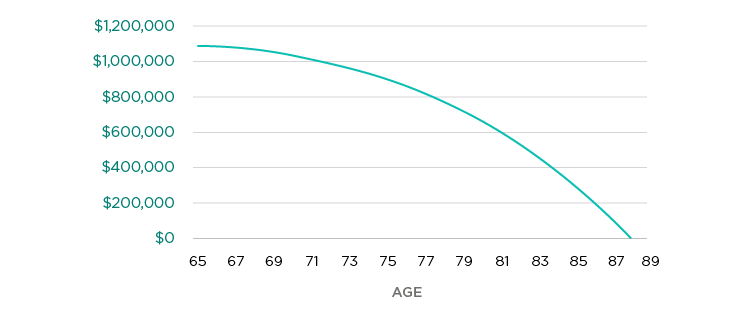

If Nick’s fund had a long-term earnings rate of 5% instead of 7%, then he’d get less mileage out of his super, which would last him until he was 88. If he lived beyond that age, he’d need to work out his living expenses. It may also mean cutting back on his spending earlier in retirement, so he can stretch his budget that little bit further. He may need to consider applying for the age pension to supplement his living expenses. Here’s how Nick’s super would track at a long-term earnings rate of 5%.

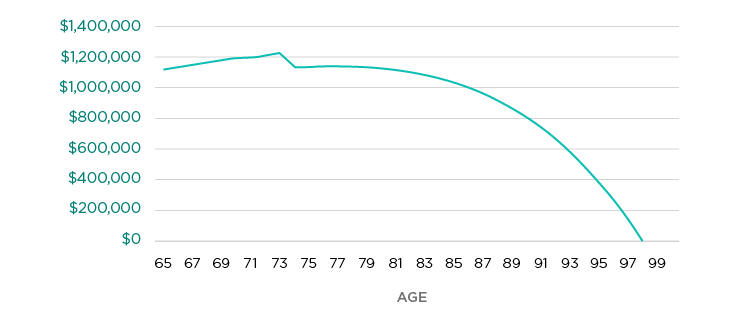

Say Nick decides to withdraw a lump sum of $100,000 in year 10 after retirement. In that case, and assuming his initial earnings estimate of 7% p.a., his super would last to about age 98.

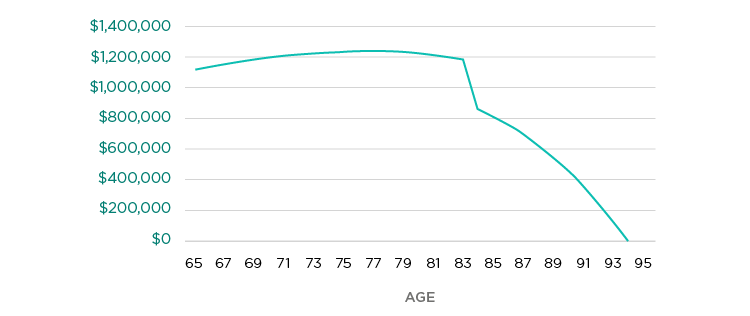

In that case, and assuming his initial earnings estimate of 7% p.a., his super would still last until he was about 95 years old. Because of the power of compounding earnings, the later lump sums are withdrawn the more favourable the overall result.

The main thing Nick needs to monitor and manage is the long-term earnings rate for his SMSF. If there’s a drop in long-term earnings, he may need to take greater investment risk if he wishes to maintain his spending pattern. Otherwise, he could maintain the same investment mix, accept the lower return and offset this with reduced spending.

When it comes to lump sum withdrawals, the longer these are delayed the better, in terms of the duration of Nick’s retirement savings.

While everyone’s situation is different, there are a set of related levers that apply for all – investment returns, drawdowns and spending.