By Graeme Colley

We take a closer look at the re-contribution strategy for the current financial year, the amount that can be withdrawn from superannuation considering the taxable component, and use of the cap from 1 July 2017.

Re-contribution strategies have been used for well over a decade for anyone who has access to a non-preserved component in their super fund. The strategies provide a useful way of converting a taxable component to a non-taxable component by making a non-concessional contribution to the fund within the cap limits. However, the re-contribution strategy does have its limitations as the potential tax saved can end up being more expensive than putting it in place. This would apply especially where the taxable component of the benefit is relatively small.

For anyone of preservation age, currently from 56 to 60 years, any amounts withdrawn from super that include a taxable component can be recontributed as non-concessional contributions up to the relevant cap. This usually results in a higher tax-free component if a lump sum or income stream benefit is drawn down prior to reaching age 60.

For those 60 or older the re-contribution strategy can be useful as an estate planning tool. The estate planning benefit arises if a death benefit is paid to a non-dependant for taxation purposes, generally a child of the member who is over 18.

Current opportunity

As proposed in the 2016 Federal Budget, from 1 July 2017 the non-concessional contributions cap will reduce from $180,000 to $100,000 for anyone with a super balance of no more than $1.6 million. The three year bring forward rule is unchanged for anyone under 65.

This presents an opportunity for this financial year: to utilise the higher cap for the purpose of re-contribution, before it falls.

The question is how much should be withdrawn from super to optimise a re-contribution strategy? The answer depends on the age of the client, the size of the taxable component, and how much of the non-concessional cap is available to make the re-contribution.

Let’s consider the situation for those under 65, wishing to withdraw an amount from super and not having triggered the three year bring forward cap since 1 July 2014. As the bring forward rule has not been activated it will allow them to maximise the re-contribution strategy for this financial year. The amount withdrawn can depend on the amount of tax they may need to pay as well as their age. Tax may be payable where the person withdraws the benefit prior to reaching age 60. If the person is between preservation age and 60, up to $195,000 of the taxable component is exempt from tax.

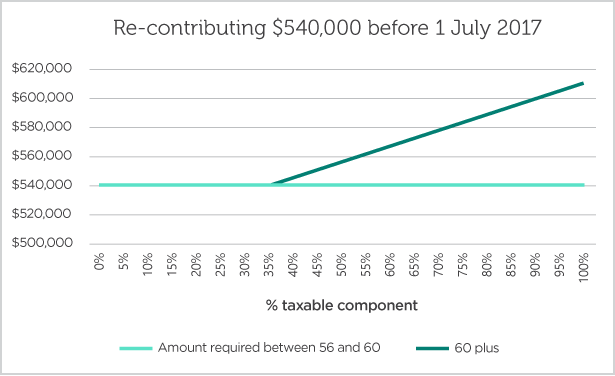

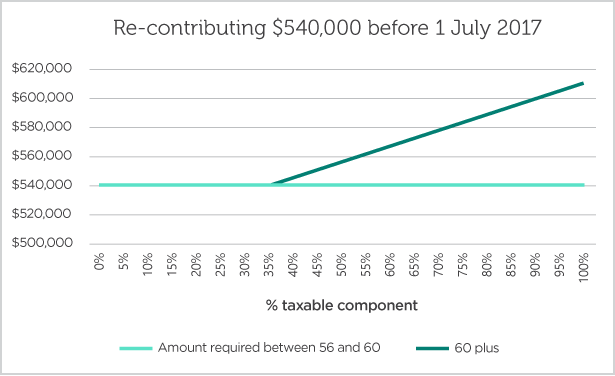

The maximum amount that needs to be withdrawn can be illustrated in the following chart.

The chart indicates the maximum amount that should be withdrawn to maximise the non-concessional contributions cap based on the taxable component of the amount withdrawn. For anyone 60 or older, as no tax is payable, the amount withdrawn would be $540,000 as no tax is payable on the amount withdrawn and re-contributed.

If the amount required is to be withdrawn between preservation age and age 60, tax becomes payable once the taxable component is greater than 36.11% of the $540,000 that will be re-contributed. This is due to the first $195,000 of the taxable component being tax exempt and assumes none of that threshold has been used previously. Therefore, if tax is payable on the amount withdrawn from the fund the gross amount withdrawn needs to take into account any tax payable. For example, if the taxable proportion of the amount to be withdrawn between preservation age and age 60 was 80% of the total amount then the lump sum to be withdrawn would be $588,542.

Re-contribution vs anti-detriment payment

The 2016 Federal Budget proposes to do away with anti-detriment payments from 1 July 2017. But for the time it remains, is it a better strategy than re-contribution?

An anti-detriment payment can be made on a member’s death where a lump sum has been made to the surviving spouse or children of the member. It is to compensate for the amount of tax paid on taxable contributions made in respect of the deceased. In some situations, the anti-detriment payment can produce a better net result after tax, however, the member needs to be deceased before the payment is made.

A decision on whether the re-contribution strategy or anti-detriment payment should be used in this financial year depends solely on individual circumstances.

Start the process soon

While the Federal Budget proposals are yet to be enacted, consideration of a re-contribution strategy should be started sooner than later. In pursuing the strategy it can take a while to get everything lined up, especially if an SMSF is involved, or the person’s super balance is nearing $1.6 million. Payment of the amount will not only involve calculating how much is required – but also determining which assets in the fund may need to be transferred or sold to enable the payment.