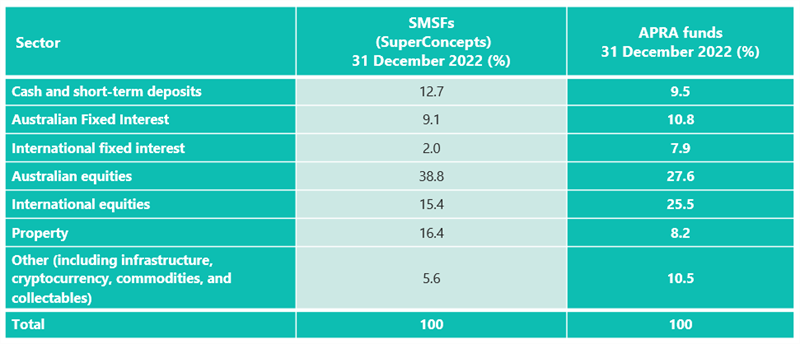

SMSF trustees, and those considering setting up an SMSF, often wonder how their investment options stack up against those of APRA-regulated funds.

In February of 2023, SuperConcepts released its quarterly SMSF Investment Patterns Survey which analyses the investments held by over 4,400 SMSFs as of 31 December 2022.

This was followed by the publication of APRA's Quarterly Performance Report which analyses investments for the same period.

The two reports provide a comparison of the overall asset allocation break-down for SMSFs and APRA funds.

It is unsurprising that SMSFs hold a greater amount of cash and liquid assets. This can be attributed to a larger percentage of SMSF members being in pension phase, and a comparatively lower level of positive cash flow resulting from contributions.

APRA funds exhibit higher exposure to international markets, which is evident in their fixed interest and equities percentages. It is noteworthy, however, that the total equity exposure is almost identical when both Australian and international markets are combined.

The disparity stems from an APRA funds' capability to access foreign markets and their recognition of the constraints imposed on their market dominance in certain Australian markets

The contrast can be largely attributed to their respective access to distinct markets. Specifically, APRA funds have better access to international fixed interest and infrastructure markets, whereas SMSF trustees are attracted to real property investments.

In conclusion, the comparison of SMSF investments to APRA-regulated funds provides valuable insights into the asset allocation differences between the two types of funds.

Their respective access to different markets, and the investment preferences of SMSF trustees, contribute to these results. Understanding these differences can be important for anyone considering moving from an APRA-regulated fund to the self-managed option.

Subscribe now and follow us on LinkedIn, Facebook, and Twitter